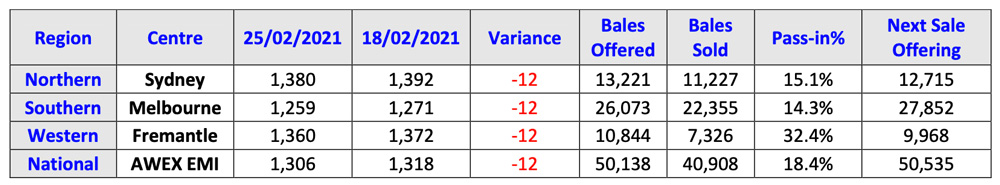

The AWEX EMI closed at 1306c - down 12c at auction sales in Australia this week. The market opened from the onset in a more cautious mode of operation as 50,138 bales went up for sale across the three selling centres. Lower prices were met with some seller resistance as the week progressed with the weekly pass in rate increasing to 18.4%. Tuesday’s sale saw the lowest pass in rate at around 8% across the selling centres but as Melbourne moved into Thursday’s sale in isolation, their pass in rate increased to 23.2%. (32.6% of the Merino Fleece)

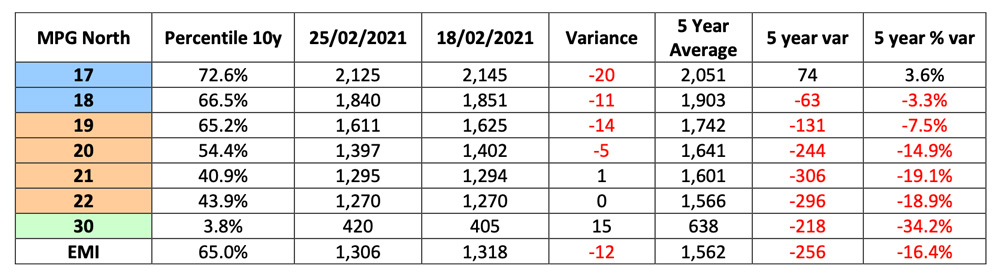

Merino Fleece: Northern region MPG’s lost 10-40c finer than 19.5μ whilst the 20μ MPG lost -5 and the 21μ MPG added 1c. As mentioned above, Melbourne sold into Thursday in isolation posting weekly losses between 20 and 50c with the market losing all composure on Thursday.

Merino Skirtings: were generally in line with the fleece however the competition on lots with heavier colour cotted wool and heavy VM was noticeably thin.

Crossbred: was the star of this week with all of the XB MPG’s rising between 4 and 35c. Whilst buyers shied away from the composite bred lots, there was a perceived urgency for the best prepared and specified lots.

Merino Cardings: came under some pressure with Sydney -7, Melbourne -21 and Fremantle -18c for the week. I understand that demand for these types have been slower over the past few weeks, and purchases this week may be for exporters stock. Crossbred oddments continued their low price trajectory, especially lots over 28μ and or containing kemp fibre.

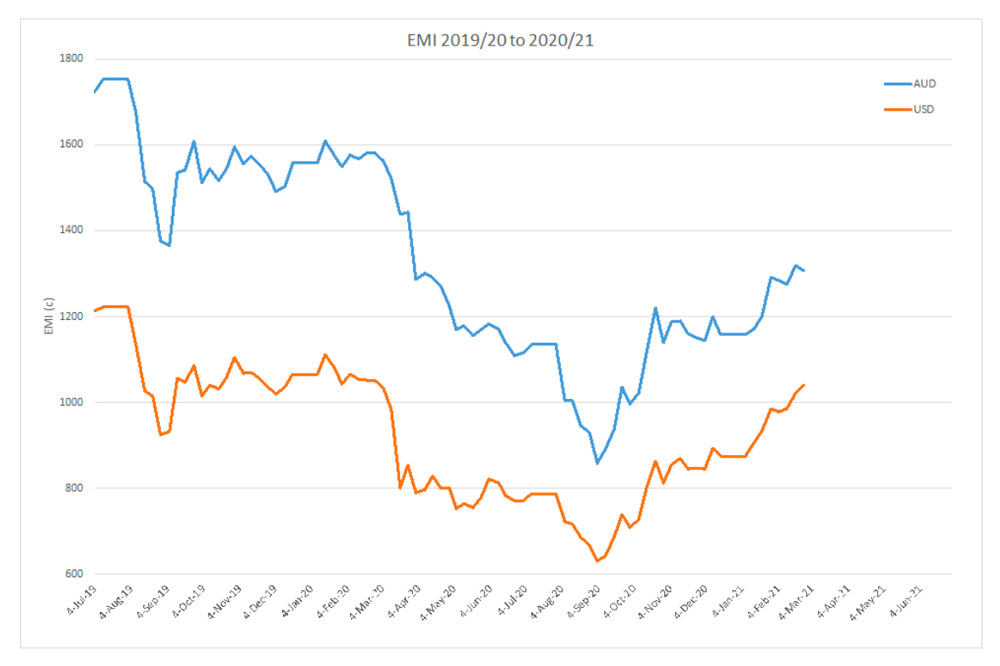

Three key underlying factors seem to be responsible for the negative price result this week: Firstly, the strong AUD exchange rate with the USD actually saw an 18c rise in the EMI in USD terms; Secondly, shipping restrictions caused by the delayed arrivals of cargo vessels has somewhat hindered the loading of exporters purchases destined for China; which brings us to the third factor which is the Australian Exporters ability to fund the purchases whilst the cost of wool has been inching up each week. The average weekly volumes over the past month has been 48,000 bales. One would hope that the shipping issues will eventually resolve however until that is resolved, some exporters may be reaching their finance limits.

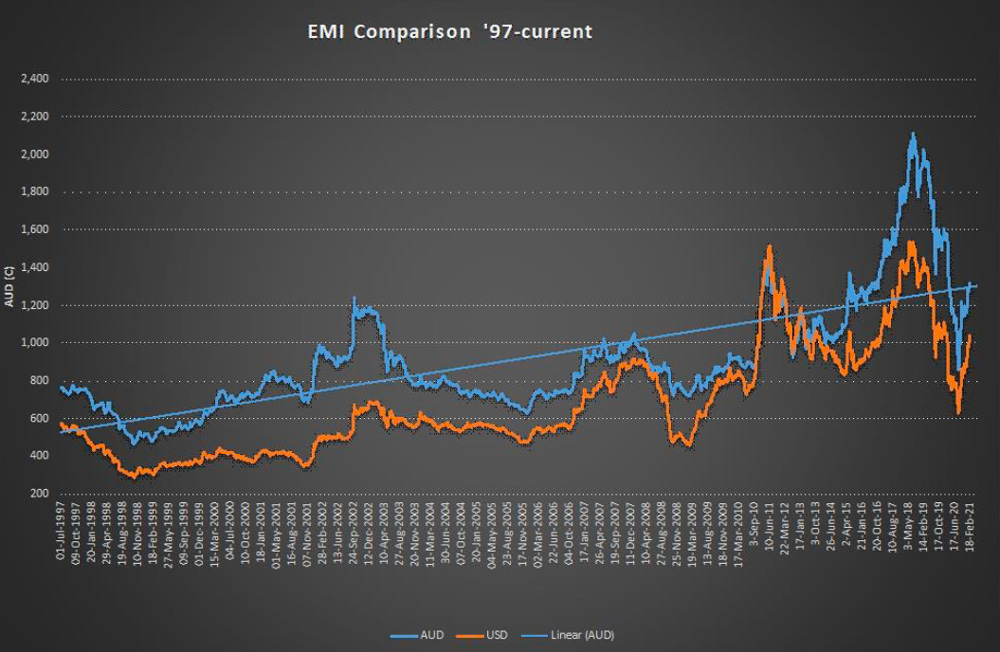

In summary, I think that the market is still in a positive phase demonstrated by the 13% rise (+157c) in the EMI over the past two months. With the emergence of new markets for our merino knitwear product continuing in China, the price for wool should continue to remain strong.

The forward market trade was subdued this week however 19 Micron prices from September 2021 right through to June 2022 is bid at the cash (1600c).

50,535 bales have been rostered for next week’s sale and I think any negative market trend will only be short lived as the issues raised above are resolved. Demand for wool looks to have reached a new level

predominantly driven from the Chinese domestic market.

__- Marty Moses __