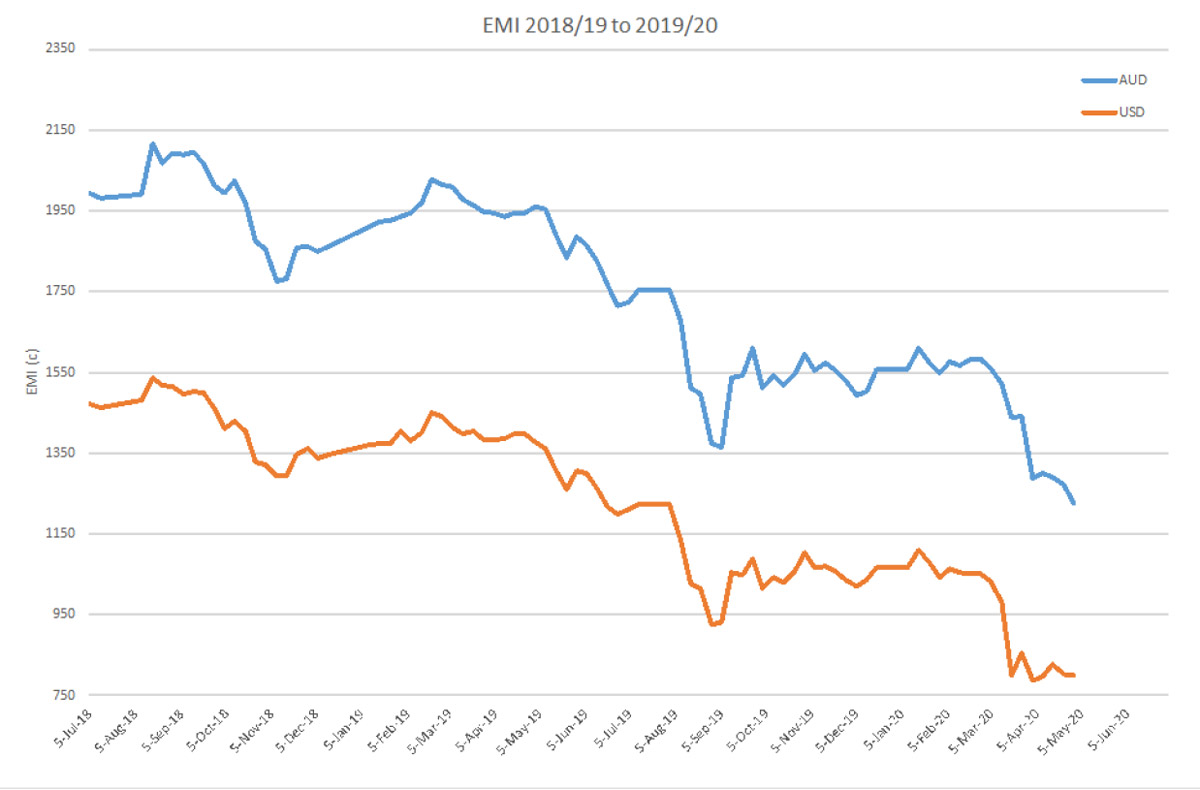

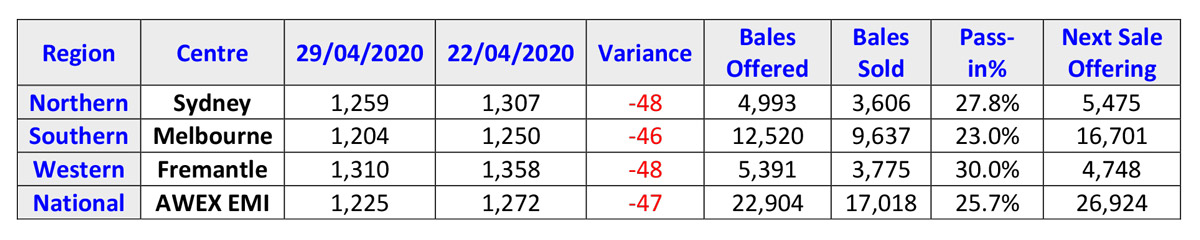

Week S44: The AWEX EMI closed on 1225c, down 47c at auction sales in Australia this week. The original offering of 25,554 bales was reduced by 10.3% presale, and the ongoing negative market trend did little to aid in transaction of the remaining 22,904 bales. The final result was just 17,018 bales sold with a passed in rate of 25.7% as wool sellers struggle with the diminishing values.

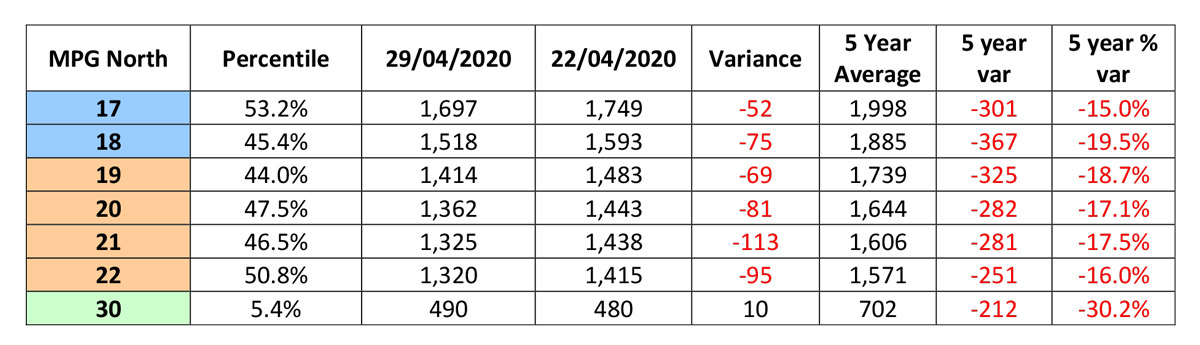

Merino Fleece was the hardest hit with across the board price falls registering between 50-90c on last week’s figures. Buyers remained focussed on the best style and specified lots however the prices fell for all types as demand worsens for our product. The low yielding fleece wools lost ground however there was reasonable competition on some of the lower yielding lots, however the price discounts remain substantial for these types.

Merino Skirtings suffered the same fate as the fleece with poor quality fleece now competing with the skirting market.

Crossbreds performed marginally better than the merino’s with falls registered between 5 and 15c. In addition there are a number of lots with questionable crosses displaying kemp and skirtings being decimated in price. In addition coarse crossbreds fleece is woeful as are Dorset fleece lots offered.

Merino Cardings posted average losses of 24c with locks, stains and crutchings falling between 10 and 40c. With the prices for coarse crossbred cardings quickly heading to being valueless.

The primary cause of this week’s fall was a lack of demand however the strengthening AUD against the greenback was too much for it to withstand. Next week is not looking too promising with very few inquiries being received from China. It is expected that Italian early stage processers will recommence to operate next week and that the shipping restrictions into India will free up progressively, however the retail for fashion has completely stalled and the pipeline will continue to suffer the consequences for some time yet.

In other news South Africa Wool sales recommenced this week under the token of selling wool that existed in broker’s stores. The SA market indicator fell 7.4% however the clearance was 92%. Last night Cape Wools announced that their negotiations had resulted in allowing the full functionality of the Wool Industry from the 1st of May.

Next week sales resume in Sydney, Melbourne and Fremantle with estimate offering 26,924 bales. Unfortunately it is expected that the market downward trend will continue. – Marty Moses