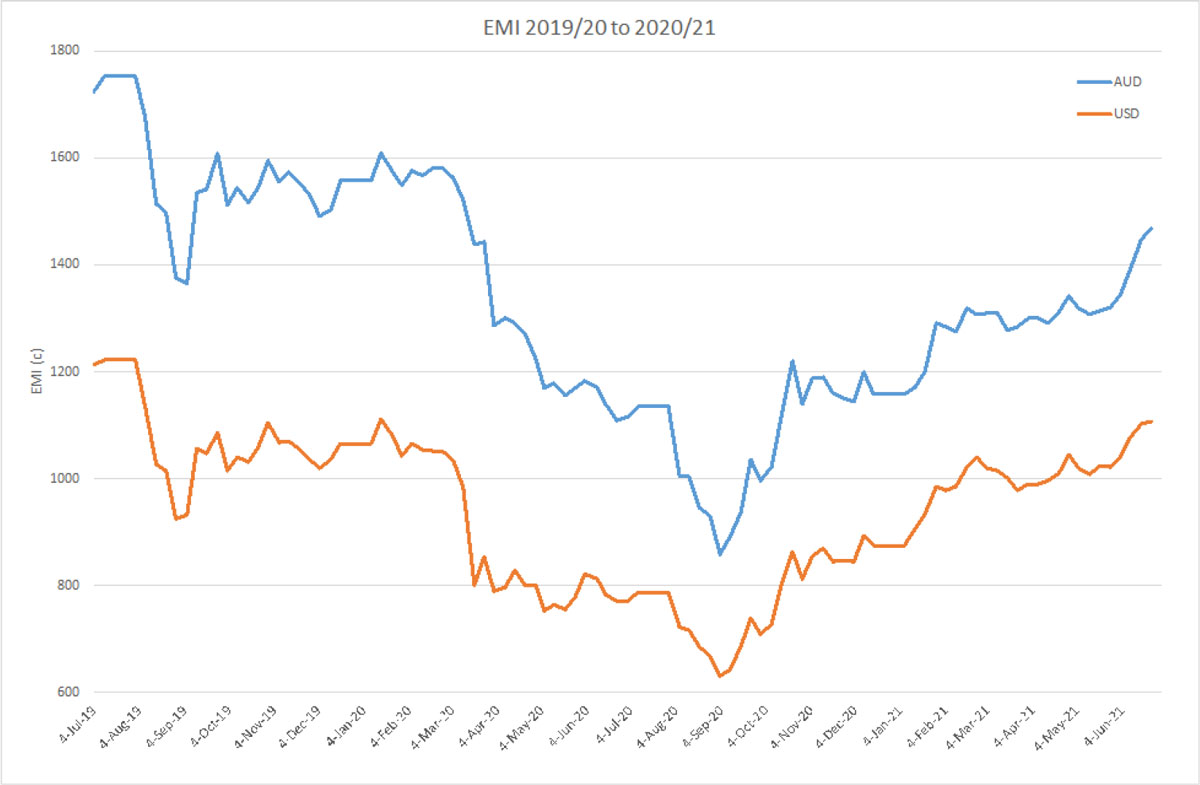

Week S52: The AWEX EMI closed on 1468c - up 20c at auction sales in Australia this week. This was the highest closing EMI since March 2020. With Fremantle sitting another week out, just 33,330 bales were offered (the smallest offering since October ’20). Competition for the merino sector was dominated by the Australian Export companies and supported by Chinese Top-makers. 95% of the offering cleared to the trade and notably, Sydney cleared 98.4% of the fleece offering, whilst Melbourne cleared 95.5%, reflecting the solid demand coming from Chinese interests.

Merino Fleece measured modest price increases of 10-24c in the 18.5µ and coarse MPG’s whilst the 18.0µ and finer MPG’s increased from 34-68c with the 16.-17µ lot adding over 100c to last week’s levels. The largest price rises were concentrated to Tuesday’s sale with a solid backup of these new levels on Wednesday. Some European interest is emerging on the Superfine best spinners types, however supply remains scant at this time of the year.

Merino Skirtings followed the fleece’s upward trend, however some weakness appeared in Melbourne in the last hour of offering on Wednesday.

Crossbreds have posted good rises as the competition broadens for these types. Price increases from 9-33c were pleasured across the XB MPG’s with the 26-28µ performing better than the 30-32 MPG’s. Whilst the price rises are welcomed, the XB MPG’s still sit below the 10th decile. There is such a long way to go for this sector before the sellers who are holding their clips will accept the price.

Merino Cardings posted small price increases of 2 and 5c respectively in Sydney and Melbourne with a weaker result on Wednesday.

Crossbred Oddments continue to struggle coarser than 26 microns whilst the 22-34µ oddments starting to gain buyer interest.

Next week 44,406 bales will be offered across all Australian selling centres as Fremantle joins the roster again. Next week is the last sale for the 2020-2021 financial year. There will be two sales in July before the commencement of the three week recess. One can only hope the market sentiment continues its positive trend into the closing sale day.

The early market intelligence is that exporters have written some business for 19µ and finer however the 19.5µ and coarser interest is slower to emerge. Some exporters have reported pressure emerging on their finance facilities, which have come under pressure with shipment and logistic delays after the fall of the hammer. For those affected, this has resulted in additional cost adding pressure to financial limits.

– Marty Moses